By Ian Ardill

I love Wealthsimple.

Not exactly what you would expect a Wealth Advisor to say.

So why do I say it? For a couple of reasons.

First, because Wealthsimple – or other do-it-yourself, “robo-advisor” platforms such as Questrade – allows people to trade for no or low fees, they hold wealth managers like Ardill Group accountable for what we are delivering. In the advisor community, we must not just earn your business, but keep it. And the results we are getting, indeed, are keeping our clients as we continue to grow.

Second, because robo-advisors help people realize that managing their own investments is riskier and more complicated than they think. People who’ve tried Wealthsimple and their competitors regularly come to me and ask for help with their portfolio, acknowledging something I fundamentally believe: no one can be an expert at everything.

Our clients are highly accomplished professionals and business owners. They are exceptional at what they do. But they are not professional wealth managers, and they recognize that hiring a professional is a wise investment.

Some investors find DIY investing challenging. Working with a professional can provide additional support, including for something we call emotional investing.

Emotional investing is when people let feelings – like fear or overconfidence – influence their financial decisions, instead of sticking to a long-term investment plan based on logic and discipline.

One of our most crucial jobs as wealth advisors is to keep our clients sticking to the plan, especially amid volatile markets.

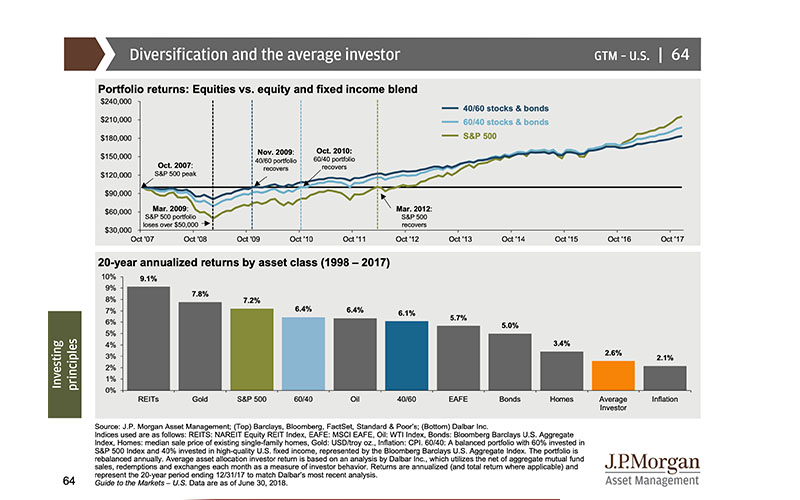

Consider a JP Morgan study comparing the average equity investor to the S&P 500 over the 20 years from 1998 to 2017 (see graph below). The average equity investor earned a return of 2.6%, barely more than inflation. The S&P 500 returned 7.2% over the same period.

How can an investor do worse than an index? Because they are making emotional investment mistakes, the most prominent of which is trying to time the market.

Urgent vs important

And there is something else: life is more complicated than ever. People simply do not have time to be watching over their investments and doing the regular maintenance required. It is that classic struggle between the urgent (the million things grabbing our attention moment to moment) and the important (the bigger picture issues that are the truly important gamechangers).

The value we provide to our clients is that your important becomes our urgent.

What is important to you?

Are you in growth mode, protection mode, income mode? Are you actively working with a wealth advisor who is helping achieve those goals? Do you know someone who needs the kind of high-touch service we provide? We look forward to showing you, or someone you care about, that we’re Just the right match for your money®.

PS Be sure to watch the video at the top of this post!

Ian Ardill, B.A., M.T.S.

Wealth Advisor

CEO, Ardill Group

Direct: 1 905 769 2004

Office: 1 905 907 7000

ian@ardillgroup.com

Ian is a Dealing Representative with Raintree Financial Solutions, an Exempt Market Dealer. Exempt Market investments are offered only through RFS, while insurance and planning services through Ardill Group are outside RFS’s supervision. Please review the official offering documents and speak with your RFS advisor to ensure suitability before making any investment.

This article does not provide sufficient information for you to make a fully informed investment decision. This article also contains forward looking statements, which include target returns that may not be predictive of actual performance. Forward-looking information is based on the current expectations, estimates and projections of the securities issuer and involve a number of unknown risks and uncertainties which could cause the actual results or events to differ materially from those presently anticipated.